r&d tax credit calculation uk

Ad Our sector specialists can maximise your RD claim. Rd tax credit calculation uk Monday March 14 2022 Edit.

Invoice Or Bill Discounting Or Purchasing Bills Trade Finance Accounting And Finance Financial Strategies

R D Tax Credit Calculation Examples Mpa How To View And Download Your Tax Documents R D Tax Credit.

. Pin On Dns Accountants If you spend money. Call today for your free review. If the company spent 100000 on RD projects in a year.

Its calculated on the basis of increases in. Weve Been In Your Shoes Want To Help. Find out what this means for you and learn how Xero can help you become MTD-compliant.

If the tax losses are lower than 230 of the total RD spend the cash benefit is restricted to 145 of the tax losses. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. Weve Been In Your Shoes Want To Help.

Profit-making SME with 10000 RD spend. Ad Our sector specialists can maximise your RD claim. Busineses In Technology Ecommerce Bio-Tech More Can Qualify.

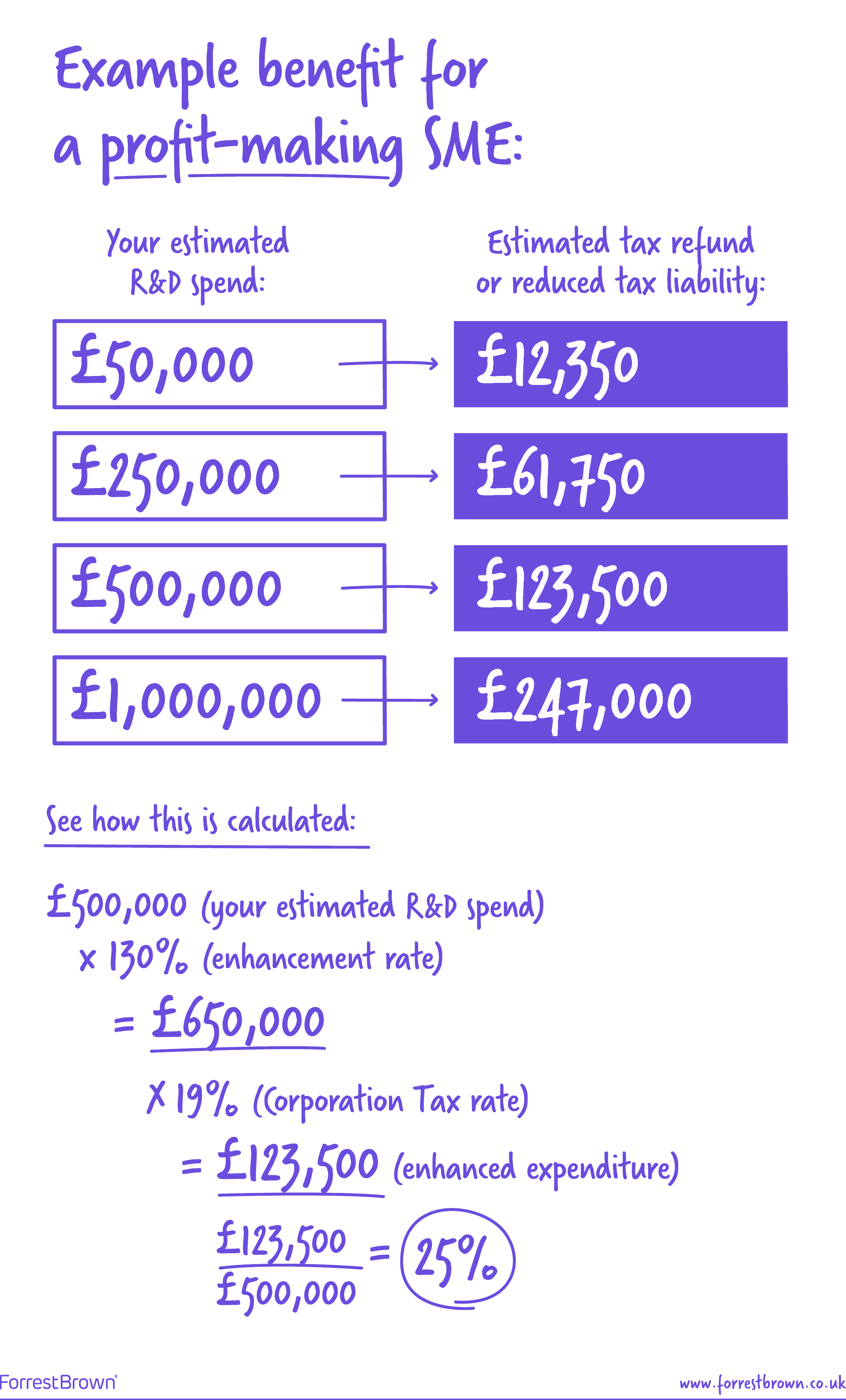

Ad MTD has changed the way UK businesses accountants and bookkeepers do their taxes. The rate of relief is 25. See If You Qualify.

This calculation example shows how RD tax credits can benefit a. Average calculated RD claim is 56000. Dont Leave Your RD Tax Credit On The Table.

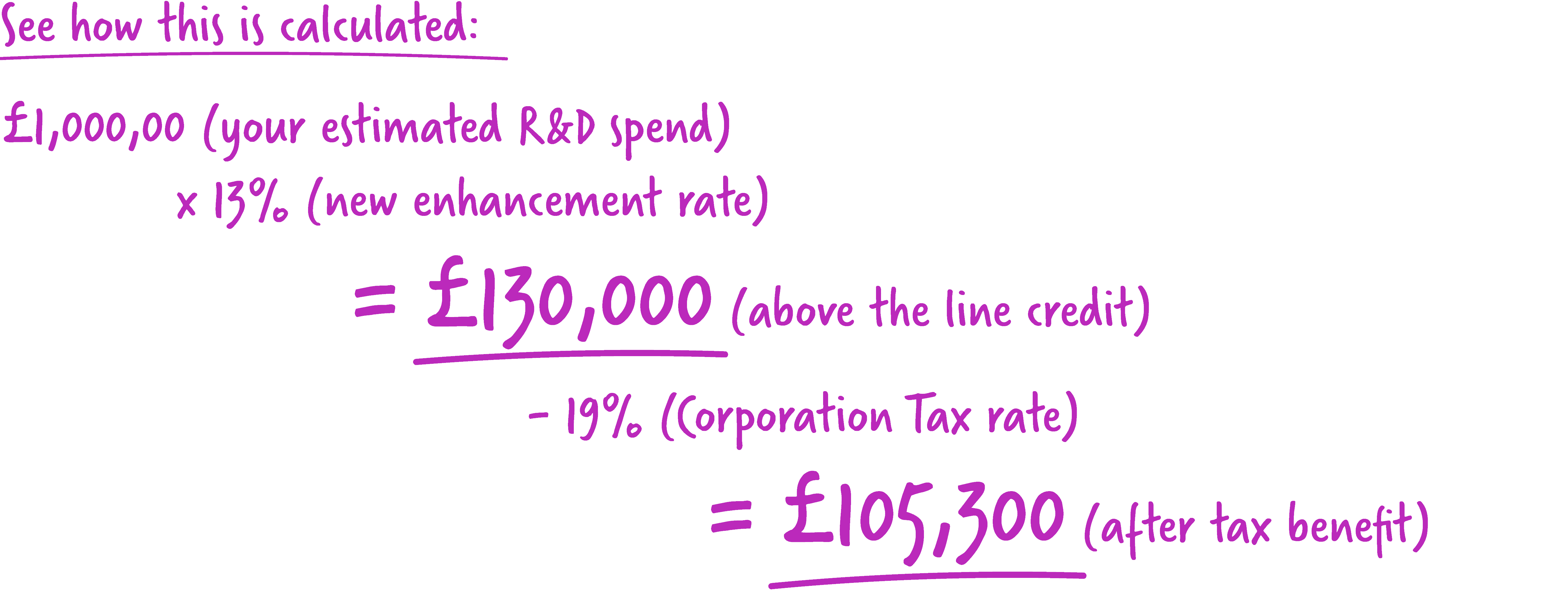

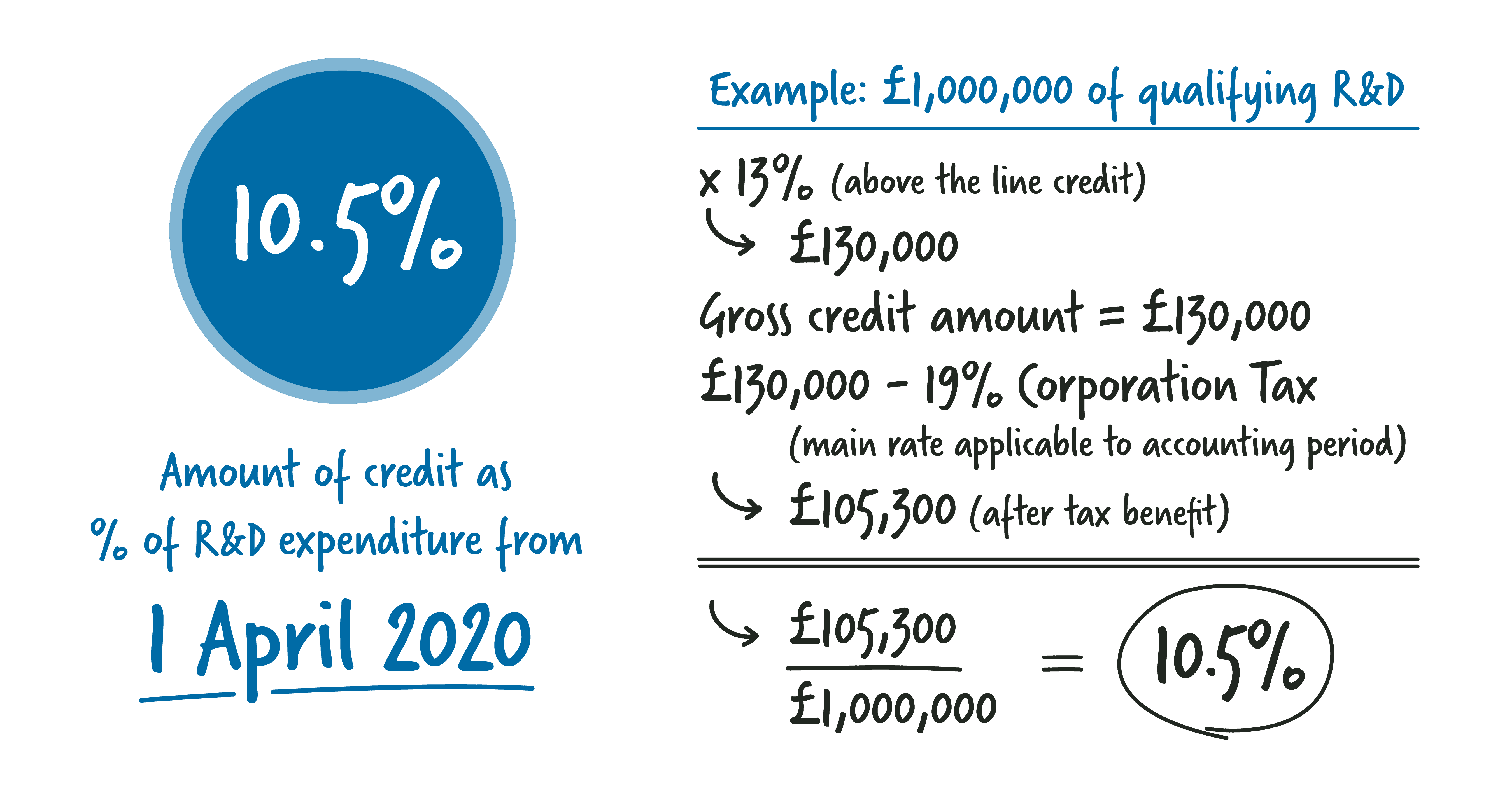

Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. First however the fix-based percentage must be obtained by.

RD Tax Credit is 212500 1453081250 CT600 boxes 530875 Losses to carry forward are zero. Ad In Under 20 Minutes See If You Can Claim A RD Tax Credit With Our Fast Easy Process. So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill.

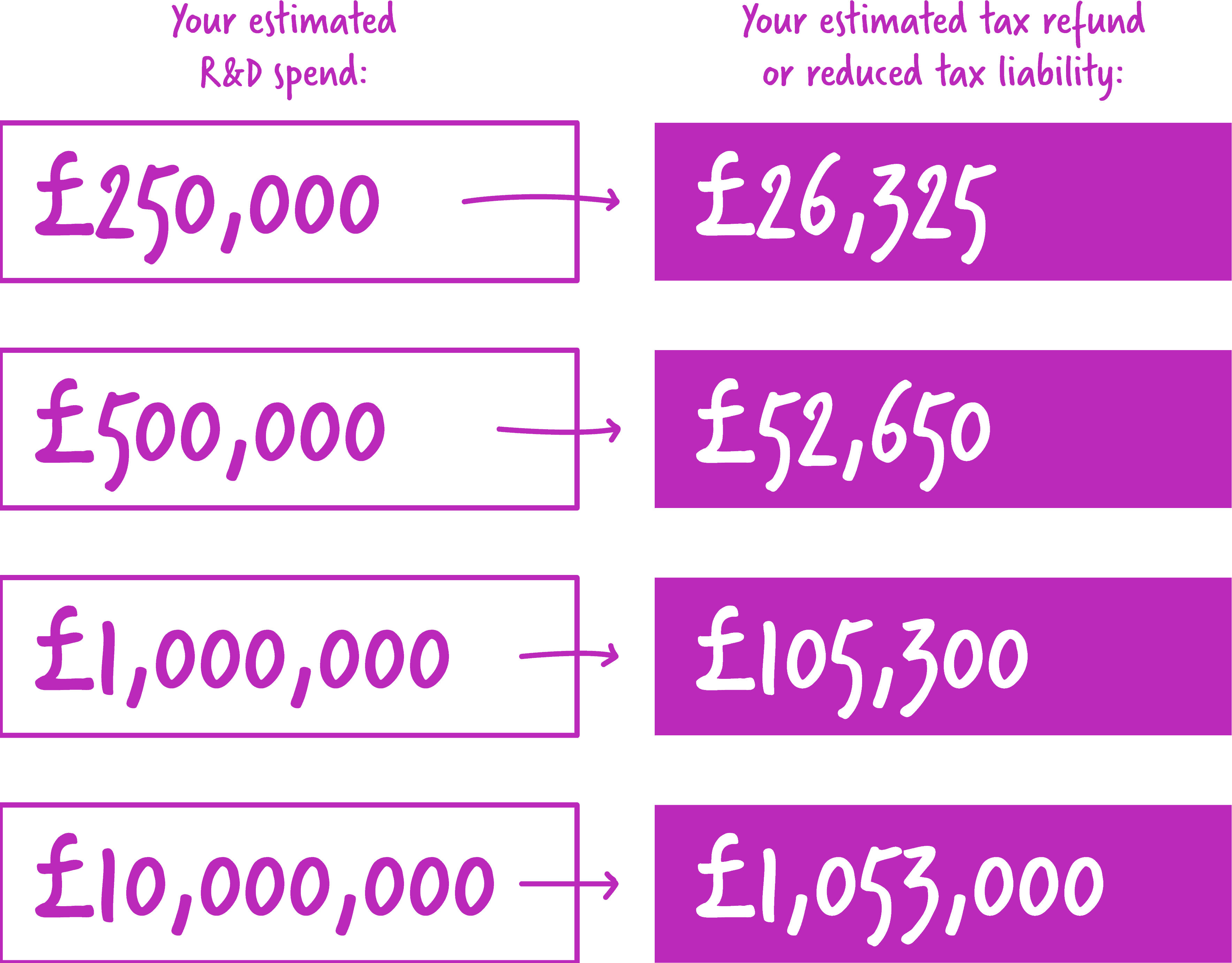

The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. Ad MTD has changed the way UK businesses accountants and bookkeepers do their taxes.

If youre a loss-making business youll receive your RD tax credit in. Ad In Under 20 Minutes See If You Can Claim A RD Tax Credit With Our Fast Easy Process. Enhanced RD qualifying spent would be now 325000 x 130 which makes the revised loss of 275000.

13000 x 19 corporation tax rate 2470. 12 from 1 January 2018 to 31 March 2020. Just follow the simple steps below.

Dont Leave Your RD Tax Credit On The Table. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they. Ad Pilot Helps Your Business Maximize Savings.

Free RD Tax Calculator. The RD tax credit is for taxpayers that design develop or improve products processes techniques formulas or software. Multiply that average by 50.

Call today for your free review. Figure the companys average qualified research expenses QREs for the past three years. It was increased to.

Rd tax credit calculator uk Friday April 22 2022 Edit. 10000 x 130 enhancement rate 13000. Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

Sample calculations for RD tax relief claims. Find out what this means for you and learn how Xero can help you become MTD-compliant. The following is for illustrative purposes only.

Subtract the result of Step 2 from the companys. One of the hard issues to understand about RD Tax. Calculate how much RD tax relief your business could claim back.

Well Handle The Entire Process For You. Surrender of losses in return for payable tax credit up to 33 of qualifying expenditure For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss. 13000 x 19 corporation tax rate 2470.

Rdec 7 Steps R D Tax Solutions

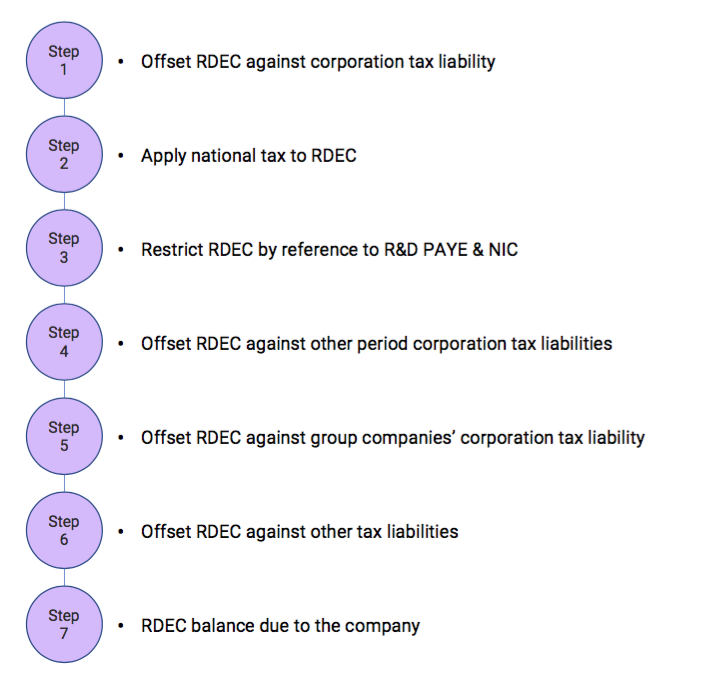

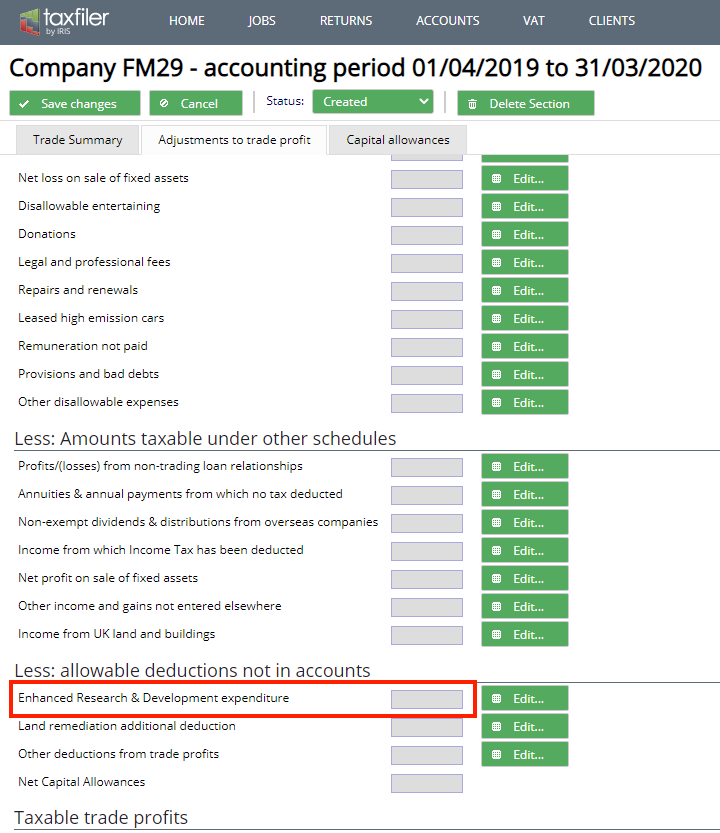

Research And Development Or Film Relief And Tax Credits Support Taxfiler

R D Tax Credit Rates For Sme Scheme Forrestbrown

Accounts Payable Cycle Definition 12 Steps Of Accounts Payable Cycle Accounts Payable Accounting Learn Accounting

R D Tax Credit Calculation Examples Mpa

Payment Of Tax Invoices Bills Concept Financial Calendar Money Magnifying Glass Accounting Tax Forms

Stock Vector Tax Calculation Flat Composition With Budget Planning Financial Charts On Computer Screens On G Financial Charts Budget Planning Gray Background

Rdec Scheme R D Expenditure Credit Explained

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

R D Tax Credit Calculation Examples Mpa

R D Advance Funding Early Access To Your R D Tax Credit Mpa

How Is R D Tax Relief Calculated Guides Gateley

R D Tax Credit Calculation Examples Mpa

Research And Development Or Film Relief And Tax Credits Support Taxfiler

R D Tax Credit Calculation Examples Mpa